The Future of Pay-TV in the age of streaming

Technology is transformative in its revolution across our industries. In the early 2000s, top executives of Netflix met the top brass of Blockbuster, which was then a $6 billion behemoth in the entertainment industry. Netflix had a meager 300 subscribers and a loss running close to 8 figures. They were looking to be acquired by Blockbuster for a measly $50 million. Blockbuster execs felt the asking price was too high and rejected the deal.

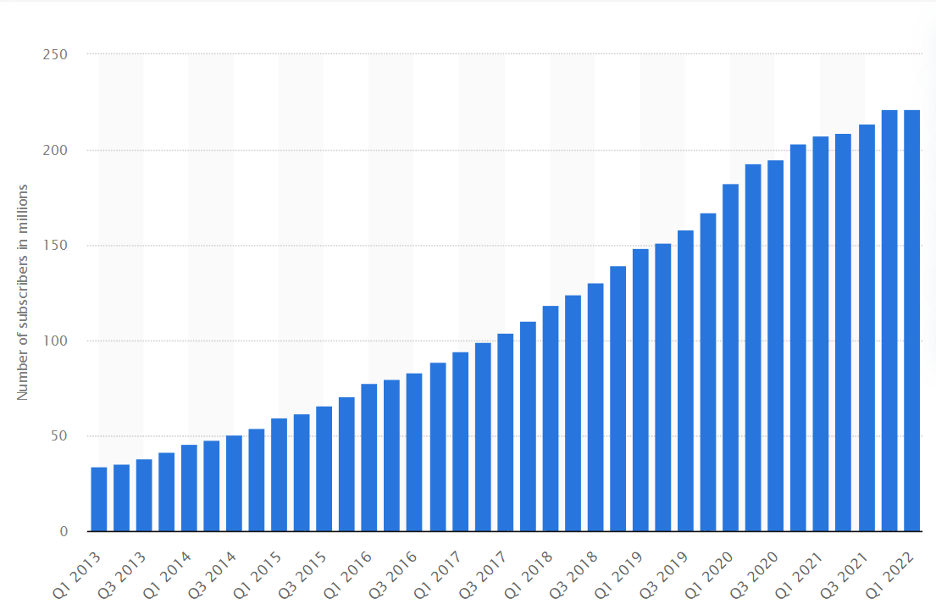

The rest is history. Netflix emerged as the glorious gladiator in the streaming domain, leading the pack, innovating content consumption, and revolutionizing the home entertainment business like no other. According to Statista, as of 2022, Netflix was leading the OTT race with a whopping paying global subscriber count of over a 221million!

Netflix Subscribers over the years

As with any industrial revolution, something had to feel the adverse effect of this global expansion, and in this case – cable TV.

How cable TV fell from grace

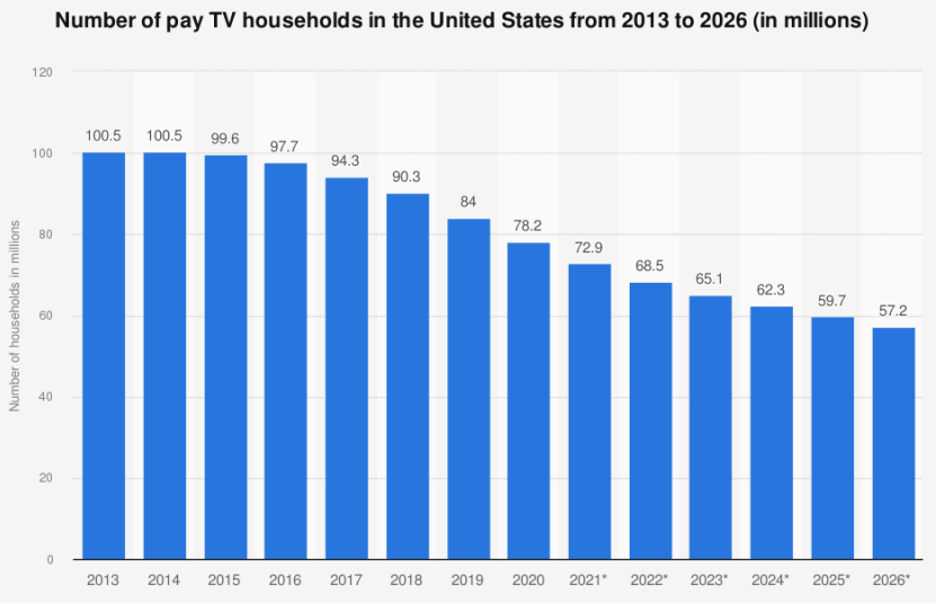

The cable TV industry was undisputed in the early to mid-2010s, with more than 105 million U.S. TV households as subscribers. They had set up shop and dominated the majority of homes as a reckonable home entertainment force.

Reaching a peak in 2012-13, cable networks saw an astronomical amount of ad commitments, and cable TV became a staple in every household. There was an exceptional revenue flow to the parent companies of network providers then, but the cable network is currently a shadow of its former self.

1.8 million Subscribers canceled their Pay-TV subscriptions in 2020. Such was the impact of streaming services and the revolution brought upon them. Simply put, streaming is the decisive force that has powered cord-cutting.

Streaming services provide users with absolute control over viewing options and content diversity, something Pay-TV has always lacked. Pay-TV also had the added deadweight of multiple immersion-breaking ads that drastically impacted viewer engagement even with good program content.

According to Statista, Pay-TV subscribers had fallen to 83 million users as of 2020; and a declining trend is forecasted for the future. But it isn’t a home run for the streaming services either; they are just arriving at the tip of the iceberg as new challenges emerge.

Two’s a company; three’s a crowd

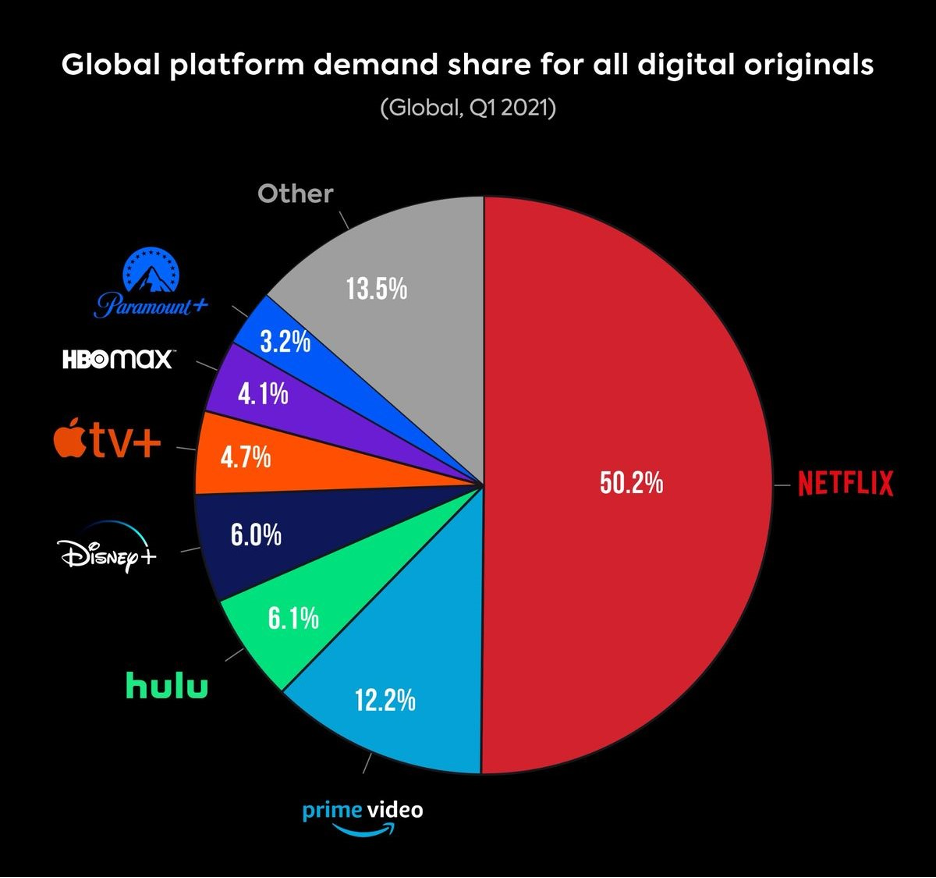

Netflix has revolutionized the home entertainment industry. It has been the leader in streaming services despite the competition; and has instrumentally driven a behavioral change in people’s content consumption habits.

The pandemic was an unpredictable event that turned profitable for streaming services as people started banking on OTT platforms for content consumption, thanks to the worldwide lockdown. The additional factors of access to high-speed internet and a device-agnostic approach to content consumption only added to the boost for the accelerated growth.

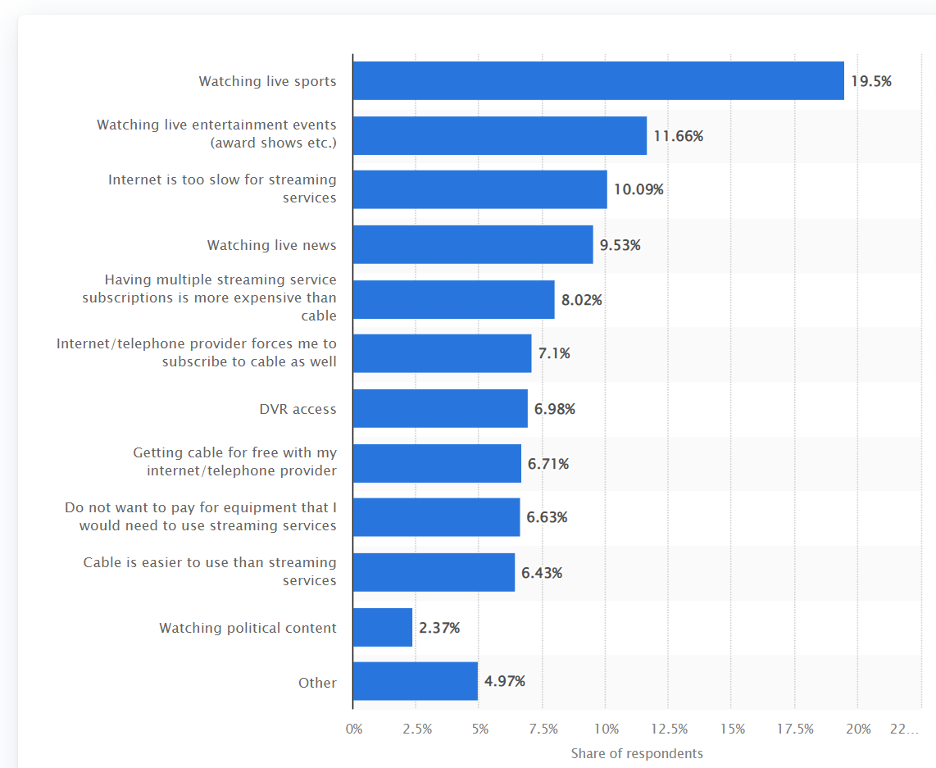

Reasons why people still have a Cable TV subscription

An ace card Pay-TV usually had was sports content. Rights to sports content fetched a fortune for these organizations, and the pandemic brought these events to a screeching halt, accelerating cord-cutting. Even though the pace has picked post-pandemic, sports is one of the biggest reasons Cable-TV subscriptions make sense for many people.

Netflix’s initial USP was its unique strategy for acquiring publishing rights for shows and movies. By paying more upfront, it was able to build a content-rich streaming library.

Players like Disney and HBO built their streaming platforms and have gotten back many of their titles from Netflix, landing a devastating blow. However, Netflix had foresight about this and had started producing original content with shows like BoJack Horseman, House of Cards, and Stranger Things doing wonders for the company.

But that wasn’t enough anymore.

On top of that, the players in the streaming market are leveling up their game, producing quality content to woo viewers. HBO Max and Apple TV have performed excellently, thanks to this strategy.

Currently, there is a considerable challenge for subscription services. Viewers are now at a crossroads as multiple streaming services own the rights to a plethora of content, and respective subscriptions are necessary to access the content.

The market is overcrowded, and everyone wants a piece of the streaming pie. Netflix has lost over $50 billion of its market cap, and its panicked investors resorted to selling their shares. On top of it, Netflix laid off many employees recently.

The combined impact of all these factors is so severe that Netflix plans to introduce a ‘basic’ account option with ads to attract more viewers and handle price-sensitive geographies. Amazon prime has already rolled out this model, and the other players may have to succumb to this trend not too far away in the future.

What’s the future for Pay-TV and streaming services?

The problem with Pay-TV isn’t just streaming services; it’s the business model. Not having the freedom of choice in terms of content and watching through many ads despite paying a monthly subscription fee were the factors for the downfall of Pay-TV. But all hope is not lost for the cable businesses.

The biggest weapon they always had was sports content. Other than that, players like Paramount, Comcast, and Viacom are already in the business of streaming, so it’s not exactly a battle to the throne. The truth is that viewer preferences and behavior have changed drastically over the years. Pay-TV needs to stand out and offer an incentive to attract users.

Pay-TV businesses can take a page out of the streaming model playbook and implement it for a taste of success. Players like Amazon are already running ads on streaming services, and Netflix plans to do it eventually with its basic account. So, running ads isn’t the issue here; the irrelevancy and bombardment of ads is, however, a critical issue. The solution – relevant, crisp ads placed in appropriate slots and personalized to suit the viewer.

Pay-TV businesses also need to stop bundling and let viewers build a package. In short, personalization is the key for both ads and content. Nobody wants to pay for a pre-built bundle of channels just to watch a couple of relevant shows, movies, and content while unnecessarily paying for content they don’t consume.

AI & ML are the elixirs for a sustainable future for Pay-TV

One of the biggest reasons for the success of streaming services was the drastic evolution of the internet and its infrastructure. Data thus became a vital bloodline for every business, and the personalization game was accessible to the streaming services thanks to their online business model.

Pay-TV always had to rely on viewership ratings and TRP from rating agencies, and there was always a time and logistical delay in obtaining data. Now that all the players have a hand in the streaming game, accessing data is not a pipe dream anymore, but wisely leveraging it is not a simple task either. Insights are only valuable when actionable output is obtainable from them.

Ads relevant to particular users, strategically placed within the content, can be a game-changer for businesses. Data analytics and intelligent algorithms are essential in performing real-time monitoring and decision-making..

The plethora of data from user profiles and viewership data powered by the right AI solution can turn fortunes around for Pay-TV to bounce back into the home entertainment business and sustain itself in the long run.

Pay-TV businesses are now assisting the streaming services by bundling several streaming options with the cable package and integrating the viewership experience across cable and streaming TV set-up boxes. With this, there isn’t a head-on clash but a prospect to co-exist and sustain for both.

For broadcast services, a marriage between Pay-TV and streaming services opens the door for valuable data that can be leveraged to offer exciting packages customized to user preferences while overcoming the cord-cutting challenge.

Can AI solutions benefit the home entertainment domain?

Pay-TV players not only need to have a quality content library but also the tools to deliver it to viewers. Relevancy is imperative, and content recommendation is the ace that wins the game. A solution called the Live TV Recommendation System provides recommendations for new programs using a content-based algorithm that finds similarities, overcoming the cold start problem. It also leverages watching habits to provide timeslot-appropriate TV recommendations to viewers.

Ad consumption has become a tricky affair. Gone are the days of long ads between programs and high-demand segments. Viewers don’t put up with ads as much as they used to. Optimal Ad Space Recommendation is a solution that considers viewer demography, preferences, and other crucial factors to analyze viewer behavior. This helps choose the best ad to display amongst your ad inventory for maximum ad engagement.

Many such solutions tailored for Pay-TV, Broadcast, and OTT platforms can accelerate their performances while efficiently achieving organizational goals. Affine has an arsenal of such solutions across multiple verticals and a track record of working with major clients across the industry.

What does Affine bring to the table?

Affine is a pioneer and a veteran in the data analytics industry and has worked with giants like Warner Bros Theatricals, Zee 5, Disney Studios, Sony, Epic, and many other marquee organizations. From game analytics to media and entertainment, Affine has been instrumental in the success stories of many Fortune 500 global organizations, and has mastered personalization science with its prowess in AI & ML.

Learn more about how Affine can revamp your media-entertainment business!

References:

Statista, DetroitNews, Bloomberg, Forbes, Srtreamingmedia, CNBC, Broadbandtvnews