Leveraging Advanced Analytics for Competitive Advantage Across FMCG Value Chain

Introduction

According to World Bank, FMCG (Fast Moving Consumer Goods) market in India is expected to grow at a CAGR of 20.6% and is expected to reach US$ 103.7 billion by 2020 from US$ 49 billion in 2016. Some of the key changes that are fueling this growth are:

- Industry Expansion – ITC Ltd has forayed into the frozen market with plans to launch frozen vegetables and fruits, aiming US$ 15.5 billion in revenues by 2030. Similarly, Patanjali Ayurveda is targeting a 10x growth by 2020, riding on the ‘ethnic’ recipes and winning consumer share of wallet.

- Rural and semi-urban segments are growing at a rapid pace with FMCG accounting for 50% of total rural spending. There is an increasing demand for branded products in rural India. Rural FMCG market in India is expected to grow at a CAGR of 14.6%, and reach US$ 220 billion by 2025 from US$ 29.4 billion in 2016.

- Logistics sector will see operational efficiencies with GST reforms. Historically, firms had installed hubs and transit points in multiple states to evade state value added tax (VAT). This is because the hub-to-hub transfer is treated as a stock transfer, and does not attract VAT. Firms can now focus on centralized hub operations, thus gaining efficiencies.

- The rising share of the organized market in FMCG sector, coupled with the slow adoption of GST by wholesalers has led many FMCGs to explore alternative distribution channels such as direct distribution and cash-and-carry. Dabur, Marico, Britannia, and Godrej have already started making structural shifts in this direction.

- Many leading FMCGs have started selling their brands through online grocery portals such as Grofers, Big Basket, and AaramShop. The trend is expected to increase with a strive towards cashless economy, and evolving payment mechanisms.

- Traditional advertising mediums have seen a dip with the advent of YouTube, Netflix, and Hotstar.

Digital medium is being used more and more for branding and customer connect.

On top of this, barriers to new entrants in FMCG sector are eroding, owing to a wider consciousness of consumer needs, availability of finance and product innovations. This has raised the level of competition in the industry and generated a need to rethink the consumer offer, route to market, digital consumer engagement and premiumization.

In the above context, few buzzwords are circulating the FMCG corridors such as Analytics, Big data, Cloud, Predictive, Artificial Intelligence (AI) etc. They are being discussed in the light of preparing for the future – improved processes, innovations and transformations. Some disruptive use cases are:

- With growing focus on direct distribution, AI becomes all more important to help sales personnel offer right trade promotions on the go.

- With rising organized sector in urban segment, machine learning can improve the effectiveness of Go to marketing strategy by allowing customized shelf planning for various kinds of retailers.

- AI can help recognize customer perceptions based on market research interviews, make predictions about their likes/dislikes, and design new targeted product offerings. For instance, a leading FMCG brand uses AI to recognize micro facial expressions in focus group research for a fragrance to predict whether the customer liked the product or not. On the same lines, Knorr is using AI to recommend recipes to consumers based on their favorite ingredients. Consumers can share this information via SMS with Knorr.

- AI enabled vending machines can help personalize consumer experience. Coca Cola has come with an AI powered app for vending machines. The app will personalize the ordering experience to the user, and allow ordering of multiple drinks ahead of time. It will also customize in-app offers to keep people coming back to the vending machine.

- With increasing adoption of the digital medium, Internet of things (IoT) enabled Smart manufacturing is creating havocs in the manufacturing function. IoT framework allows sensing of data from machine logs, controllers, sensors, equipment etc. in real-time. This data can be used to boost product quality compliance monitoring and predictive maintenance & scheduling.

Let’s go through some of the analytics use cases across FMCG functions that promise immediate value.

Function Wise Analytics Use Cases in FMCG

Go To Marketing

Go to Marketing plays a very important function in FMCG value chain by enabling products to reach the market. FMCG distribution models range from direct store delivery to retailer warehousing to third party distributor networks. Further complications arise due to the structure of the Indian market – core market vs. organized retail. Analytics can help optimize the GTM processes in multiple ways:

- Network planning can help in minimizing logistics cost by optimizing fleet routes, number of retail outlets touched, order of contact and product mix on trucks in sync with each retailer’s demand.

- Inventory orders can be optimized to reduce inventory pile-ups for slow moving products, and stock outs for faster moving products. SKU level demand forecasting followed by safety stock scenario simulations can help in capturing the impact of demand variability and lead time variability on stock outs.

- Assortments intelligence promises a win-win situation for both FMCGs and retailers. Retailers increase margins by localizing assortments to local demand while FMCGs ensure a fluid movement of right products in right markets.

- Smart Visi cooler allocations can help in increasing brand visibility and performance. Visi coolers come in different shapes and sizes. Traditionally, the sales personnel decide what kind of visi cooler to give to which retailer based on gut based judgment. Machine learning can be used to learn from retailer demand, performance and visibility data to make an optimal recommendation, thus improving brand visibility and performance.

Supply Chain & Operations

Analytics has percolated the supply value chain deeply. IoT is being popularly identified as the technology framework that will lend major disruptions with pooled data sources such as telemetry (fleet, machines, mobile), inventory and other supply chain process data. A couple of key applications are:

- Vendor selection using risk scores based on contract, responsiveness, pricing, quantity and quality KPIs. Traditionally, this was done based on the qualitative assessment. But now, vendor risk modeling can be done to predict vendor risk scores, and high performance-low risk vendors can be selected from the contenders.

- ‘Smart’ warehousing with IoT sensing frameworks. Traditionally, warehouses have functioned as a facility to only store inventory. But, IoT and AI have transformed it into a ‘Smart’ efficiency booster hub. For instance, AI can be used to automatically place the incoming batches on the right shelves such that picking them up for distribution consumes lesser resources and hence lesser cost.

Sales

Since FMCG sales structure is very personnel oriented, use cases such as incentive compensation, sales force sizing, territory alignment and trade promotion decisions continue to be very relevant.

- Sales force sizing can be improved through a data-driven segmentation of retailer base followed by algorithmic estimation of sales effort required in a territory.

- Trade promotion recommendations can be automated and personalized for a retailer based on historical performance and context. This will allow sales personnel to meet the retailer, key in some KPIs and recommend a personalized trade promotion in real-time.

Marketing

Analytics has always been a cornerstone for enabling marketing decisions. It can help improve the accuracy and speed of these decisions.

- Market mix modeling can be improved by simulating omnichannel spend attribution scenarios, thus optimizing overall marketing budget allocation and ROI.

- Brand performance monitoring can be made intuitive by using rich web based visualizations that promise multi-platform consumption and quick decision making.

- Sentiment analysis can help monitor the voice of customers on social media. Web based tools can provide a real-time platform to answer business queries such as what is important to customers, concerns/highlights, response to new launches & promotions etc.

Manufacturing

With the advent of IoT, AI and Big data systems, use cases such as predictive maintenance have become more feasible. Traditionally, the manufacturer will need to wait for a failure scenario to occur a few times, and then learn from it, and predict the re-occurrence of that scenario. Companies are now focusing on sensing failures before they happen so that the threat of new failures can be minimized. This can result in immense cost savings through continued operations and quality control. The benefits can be further extended to:

- Improved production forecasting systems using POS data (enabled by retail data sharing), sophisticated machine learning algorithms and external data sources such as weather, macroeconomics that can be either scraped or bought from third party data vendors.

- Product design improvisations using attribute value modeling. Idea is to algorithmically learn what product attributes are most valued by consumers, and use the insights to design better products in future.

Promotions and Revenue Management

Consumer promotions are central for gaining short term sales lifts and influencing consumer perceptions. Analytics can help in designing and monitoring these promotions. Also, regional and national events can be monitored to calculate the promotional lifts, which could be used for designing better future promotional strategies.

- Automated consumer promotion recommendations based on product price elasticity, consumer feedback from market research data, cannibalization scenarios and response to historical promotions.

A key step in adopting and institutionalizing analytics use cases is to assess where you are in the analytics maturity spectrum.

Analytics Maturity Assessment

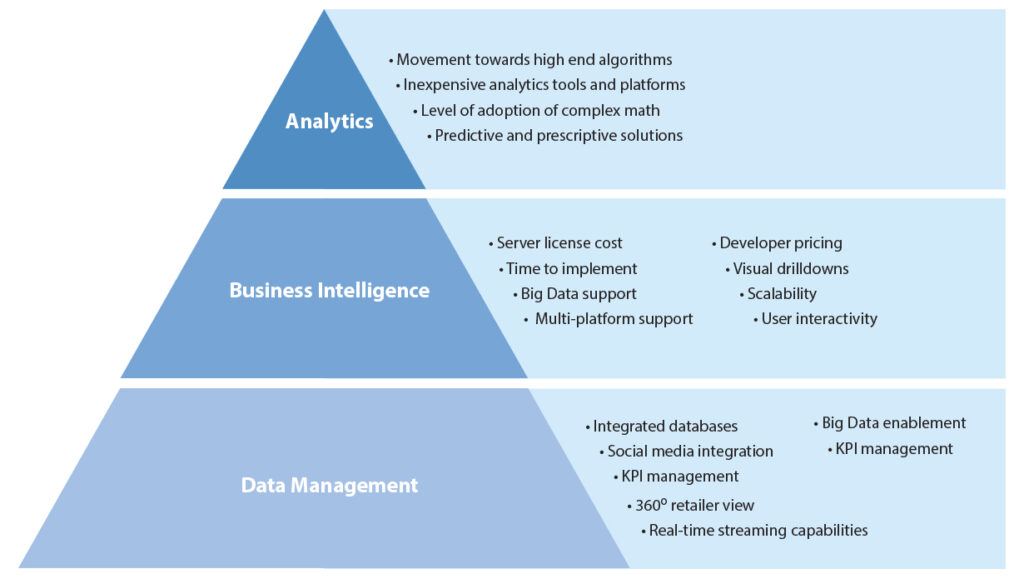

A thorough analytics maturity assessment can help companies to understand their analytics positioning in the industry, and gain competitive advantages by enhancing analytical capabilities. Here are few high-level parameters to assess analytics maturity:

Now that we understand, where we are in the journey, let’s look at “How do we get there?”

Levers of Change

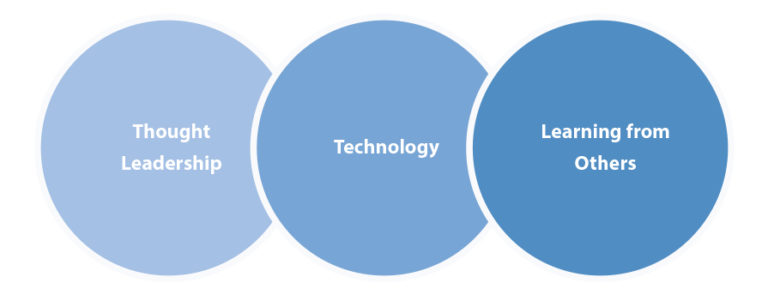

FMCGs need to adopt a multi-dimensional approach with respect to adapting to the changing trends. The dimensions could be:

- Thought Leadership: Companies need to invest considerable effort in developing a research and innovation ecosystem. We are talking about leapfrogging the traditional process improvement focus and getting on the innovation bandwagon. This requires hiring futurists, building think tanks inside the company, and creating an ‘’Edison mindset’’ (Progressive trial-error-learning mindset).

- Technology: Traditionally, companies have preferred the second-mover route when it comes to adoption of a newer technology. The rationale is that of risk avoidance and surety. With analytics enablement technologies such as Big data and cloud, this rationale falls to pieces. Primarily because, you are not the second-mover, but probably a double or triple digit move owing to widespread adoption across industries. Analytics enablement technologies have become a necessity for organizations.

- Learning from Others: Human beings are unique in having the ability to learn from the experience of others. This ability helps them not only correct their errors but also find new possibilities. Similarly, can FMCG learn from modern fast fashion retailers and revolutionize the speed to market? Can it learn from telecom and hyper-personalized offerings? Can it learn from banking and touch the consumer in multiple ways?

Harmonizing above levers along with relevant FMCG contextualization can lead to the desired transformation.