Product Pricing

What elements do we consider when selecting a product’s price? Is it entirely dependent on customer demand? Firms & marketers are constantly striving to unfold the relationship between sales demand and price fluctuation to find a pricing point that is best for their products. Let us look at price elasticity to reveal the facts behind this relationship.

What is Price Elasticity?

Price elasticity of demand (PED) is an economic measure representing the responsiveness, or elasticity, of the quantity demanded to the change in the price of a product or service. To simplify, it is the ratio of percentage change in quantity demanded of a product in response to the percent change in its price.

Most markets are sensitive to the price of a product or service, the cheaper the product higher the demand, and vice versa. While this need not be true for all products and services, price elasticity as a quantifiable phenomenon shows precisely how sensitive customer demand can be for a product price. For starters, let us look at questions professionals in marketing try to answer when determining the elasticity of their products:

- How much more can you sell by lowing the product price?

- How will the rise in the price of one product affect sales of the other products?

- How will a decrease in the market price of a product affect the volume of production & market supply?

What Is Price Elasticity of Demand & Supply?

Let’s look at Coca-Cola to try and understand these concepts. Assuming that a bottle of Coca-Cola regularly costs $1, if the price surges to $2, it will likely result in a dip in demand as most people would consider it expensive. On the other hand, if you drop its price to 10¢, you will notice a significant rise in its demand.

Price elasticity springs from the fundamental economic law of supply and demand:

- Cheaper the product, the higher the demand

- And the more expensive a product becomes, the lower the demand

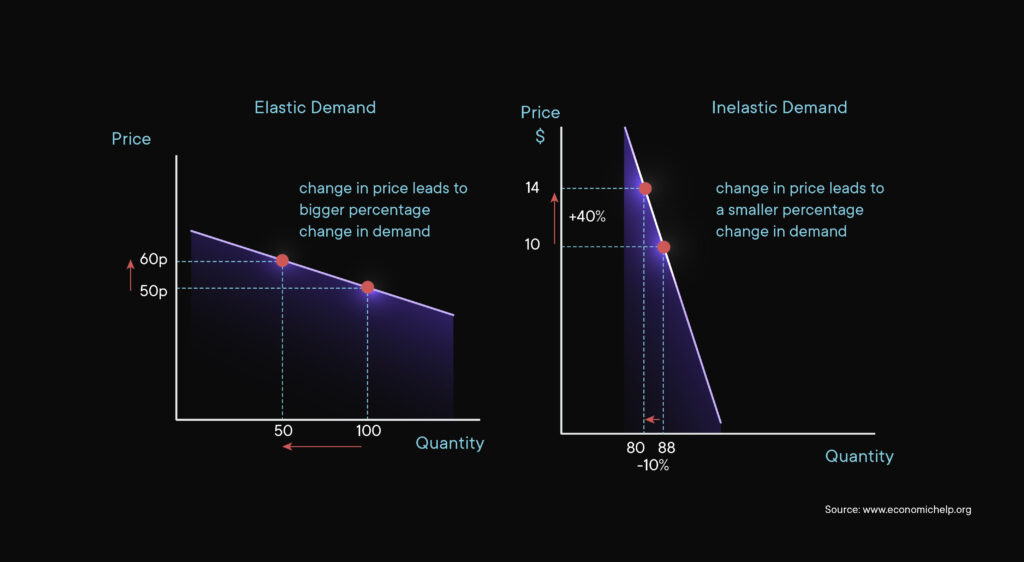

How likely is Sales Demand to Change When Price Changes?

Price elasticities are usually negative; when our price decreases, our sales demand increases. It makes sense, doesn’t it? However, positive price elasticities are found in rare cases where products do not conform to the law of demand.

Yes, these case scenarios happen when we have Veblen goods. Veblen goods are typically high-quality, exclusive, and a status symbol. Example – Louis Vuitton

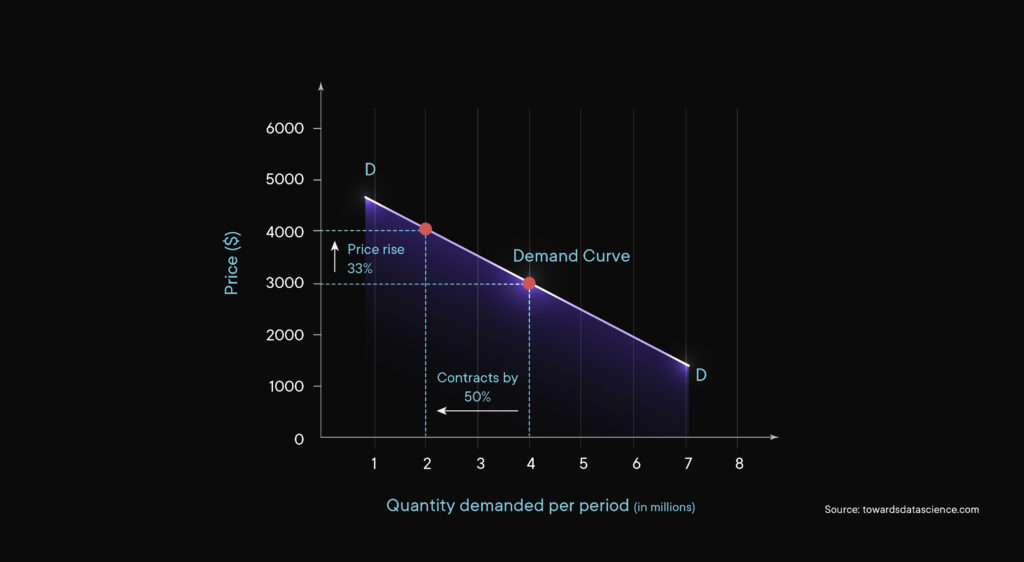

What will the Price vs Consumer Demand Curve Look Like?

The chart above shows that a 33% increase in price point decreases consumer demand by a million, whereas demand doubles if we drop it by 50%.

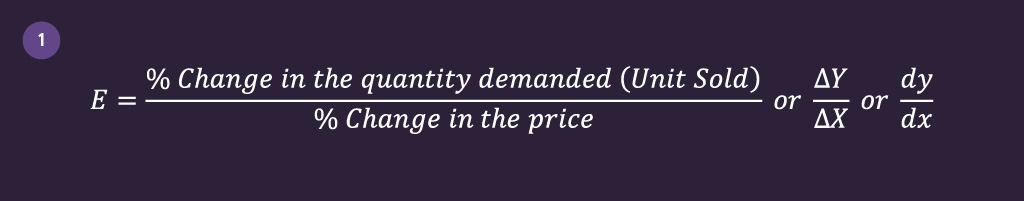

Mathematical formula to calculate the price elasticity –

Price elasticity (E) is the percentage change of an economic outcome (which is generally the number of units sold) in response to a 1% change in its price:

Where:

% Change in Quantity Demanded = (New Quantity – Old Quantity)/Average Quantity,

% Change in Price (P) = (New Price – Old Price)/Average Price

For example, let’s say that a clothing company raised the price of a coat from $100 to $120, and the 20% increase in price caused a 10 % decrease in the quantity sold from 1,000 coats to 900 coats. Formulating these numbers gives you a price elasticity of demand which is 0.5, as mentioned below:

-.10 / -20 = -0.5 or 0.5

Types of Price Elasticity

- Perfectly elastic: Minimal change in price results in a substantial change in the quantity demanded

- Relatively elastic: Minor changes in price cause a tremendous change in quantity demanded (E > 1)

- Unit elastic: Any change in price is matched by an equal change in quantity (E =1)

- Relatively inelastic: Substantial change in price causes minor changes in demand (E < 1). Gasoline is a good example. As an essential commodity, demand stays relatively the same even with an increase in its price.

- Perfectly inelastic: Quantity demanded does not change even with a price change. There is no elasticity of demand or supply for these products. Perfect inelasticity happens with products or services where the consumers do not have any other substitute goods. For example, food, medication, etc.

Factors of Price Elasticity:

- Purchase probability: The likelihood of a customer purchasing a product from a particular category. For instance, in the case of beer, where there may be various brands with differing prices from the same product category, purchase probability determines how likely a customer will buy one brand instead of the other. Assuming we can compute the aggregate price of a category and according to the rule of demand, the higher the price, the lesser the demand, and the likelihood of purchasing beer decreases with the aggregate rise in its price. Calculating the price elasticity reveals this change in demand.

- Brand choice probability: Brand choice probability defines the customer’s choice. If you work for Oreo, you are more likely to be concerned with Oreo’s brand compared to the overall biscuit sales. That is why marketers focus on persuading clients to select their brand over their competitors. When the cost of a product from a brand increase, the chance of purchasing that brand decreases.

- Purchase quantity: Purchase quantity represents a customer’s expected purchase.

Analytical Model Implementation

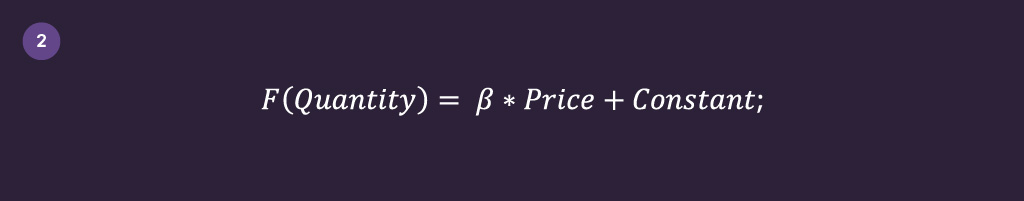

We understand the business context of price elasticity and how important it is for every business to maintain a healthy financial sheet. The following operational question is how to solve / implement it. We have used Linear regression, either the Ordinary Least Square (OLS) or Recursive Least Squares (RLS) method, to predict quantity from the price change over time for any specific product.

Linear Regression Equation:

Where,

β is the beta coefficient (slope). Generally, beta is negative with respect to quantity sold, except for few exceptions where it can be positive.

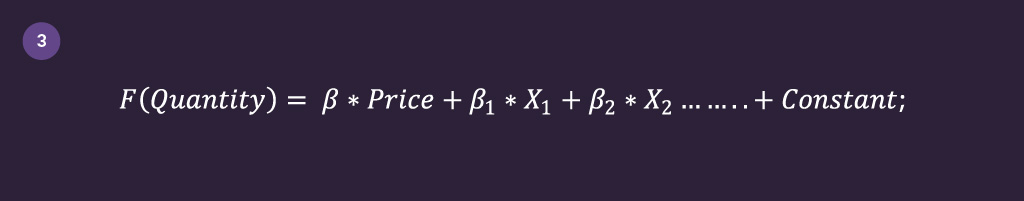

Multivariate Linear Regression:

If additional supporting factors are directly linked with sales, we may utilize them in multivariate linear regression alongside the price variable.

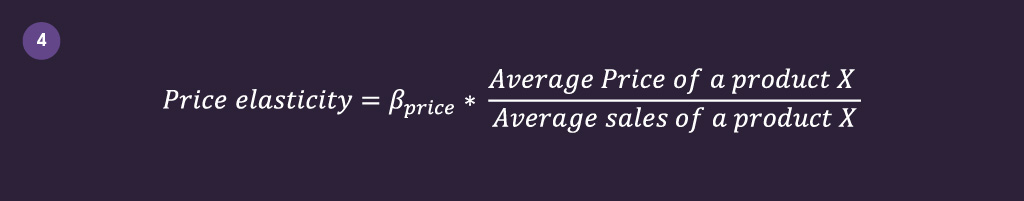

Price Elasticity Score:

To get the elasticity value of a product, we need to use equation #1 from above:

As price & unit have a linear relationship, beta (dy/dx) will remain constant. Hence, we can use the average value of price & units to get the elasticity score.

Business Application:

Once ready with the price elasticity model, the next step is to apply the business learning to reveal a product’s sensitivity in the market

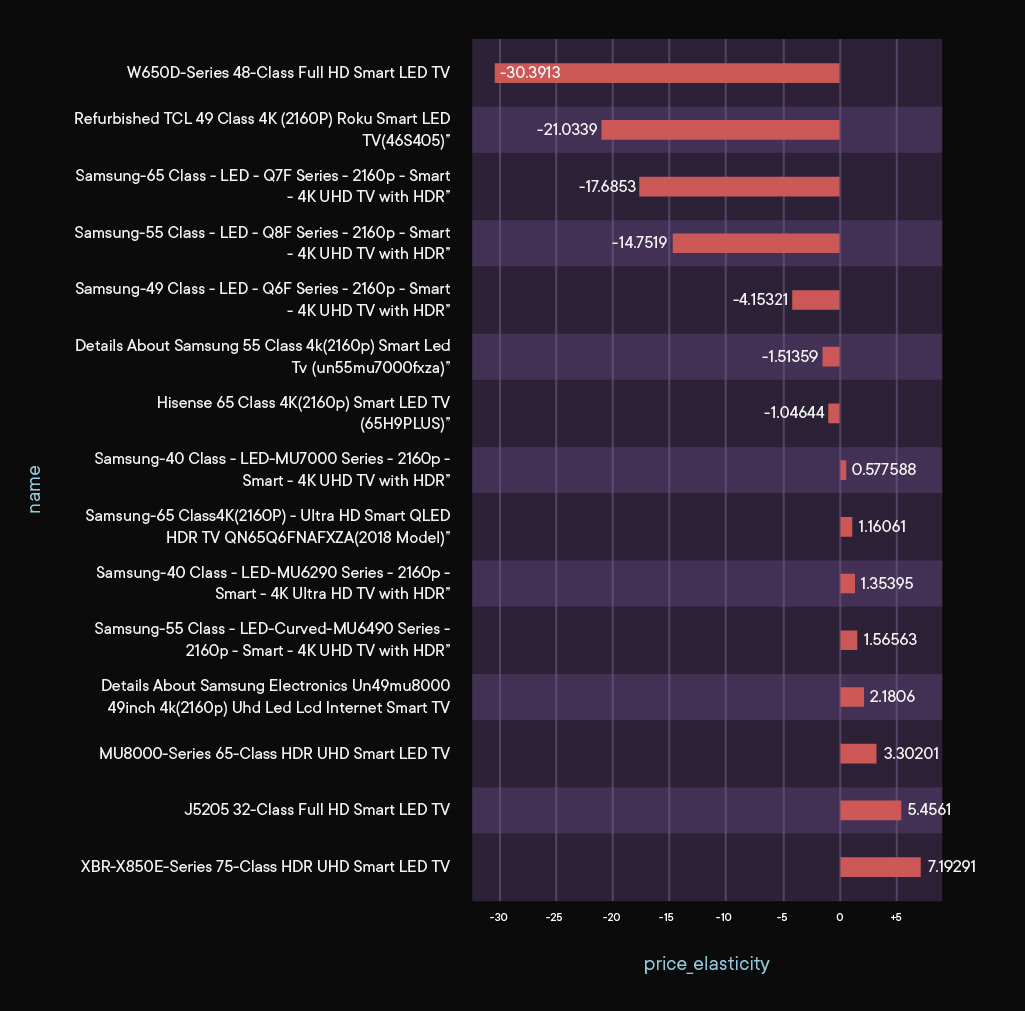

The above chart shows that the Samsung-65 Class LED TV with a negative price elasticity of -17.68 will have 170.6% more demand with a 10% drop in its price or lose 170.6% of its sales demand with a 10% rise in price.

Whereas the Sony XBR-X850E-Series 75-Class TV with a positive price elasticity of 7.19 will notice a 71.2% drop in its sales demand with a 10% price reduction and a 71.2% boost in sales demand with a 10% increase in its price.

What Next?

New problems arise the moment you solve a business problem. For instance, what is next? Or is there a better approach? What can we do additionally to improve the implemented solution? The case is the same for price elasticity models. We see that changing the price of a product affects its sales. But what happens with a change in the price of a competitor’s products? The phenomenon that causes a shift in demand for one product from a change in the price of competing products is known as Cross-Price Elasticity. But more on that in the next blog!

References